Real-time payments made simple

Send and receive funds inmediately with SPEI®, CoDi®, and DiMo®. Consult your transactions automatically. Ensure secure and fast transactions tailored to your business needs.

We are a licensed fintech, authorized by:

Multiple companies trust Sistema de Transferencias y Pagos

Total control of your company's finances begins here

Send money in real-time!

Instantly disburse funds through our digital payment methods such as SPEI®, CoDi®, and Dimo®. Integrate our payment solutions into your business model.

Receive Payments at anytime and reconcile them easily

Through unique CLABE accounts, our service automatically identifies and register each payment, enabling efficient and seamless reconciliation.

Enhance your Business Model with our tailored Technological Integration

Integrate your system directly with STP through our APIs. Automate the sending, receiving, and reconciliation of funds in real time.

Your Payment and Collection Information on a Centralized Dashboard

View and manage all of your transactions from our Financial Link, with quick access to detailed reports.

Easy Electronic Transfers

Automate and simplify your company's payments and collections via real-time electronic transfers. Make massive payments 24/7 and identify your clients through the assignment of unique CLABE accounts.

Learn more

Digital payments with QR codes and notifications in your users' banking app

Offer your clients a fast and secure way to pay directly from their smartphones; generate QR codes or send payment requests straight to their banking app.

Learn more

Dimo®: Transfer money more easily

It's an alternative to traditional SPEI® transfers, allowing you to make payments quickly and securely using only the recipient's phone number. No need to register their CLABE account!

Learn more

Integrated Utility Payments

Expand your offer and earn commissions on every transaction. Integrate payment options for main services in Mexico (water, electricity, internet, phone top-ups, and more) into your website or app, without pre-funding using your STP account balance.

Learn more

Account Validation (CEP)

Instantly validate any account by retrieving the holder's name and ID (RFC or CURP) through the official Electronic Payment Receipt (CEP) system, backed by the Bank of Mexico. This will help you prevent fraud and errors in your transfers by ensuring that the accounts are correct before any transactions are made.

Learn More

Customized payment technology

Multiple digital solutions for all types of businesses. Select your industry and discover how we simplify your processes. Contact us, we adapt to your needs!

Real Estate

Automate rent collections by assigning unique CLABE accounts for each property and tenant, and get instant reports to manage your clients efficiently.

E-commerce

Integrate SPEI®, CoDi®, and Dimo® into your business to offer fast and secure digital payments with no chargebacks and lower your costs on every transaction.

Consulting

Optimize the identification and reconciliation of your transactions via SPEI®, CoDi®, and Dimo®, ensuring simple and efficient processes.

Education

Simplify tuition and fee collections by assigning unique CLABE accounts to each student via SPEI® or CoDi® and reconcile each transaction received through our digital payment methods.

Crowdfunding (IFC) and Brokerage House

Receive funds from your investors in seconds by assigning unique CLABE accounts. Disburse returns to your users automatically with our technological integration via APIs.

IFPE and SOFIPO

Offer your users an alternative payment methods and integrate SPEI®, CoDi®, and Dimo® into your wallet or platform providing fast, secure, and seamless transactions complying with regulatory standards and promoting financial innovation.

Gaming and Betting

Make easy top-ups and disperse prizes instantly with real-time payments. Integrate with us to take advantage of the benefits of SPEI® and CoDi®.

Payroll

Automate your payroll distribution. Integrate with our platform to ensure your team is paid on time with real-time SPEI® transfers, allowing you to reduce errors, eliminate manual processes, and accelerate your payroll closing.

Payment Gateways and Processors

Add three additional payment methods to your solution: SPEI®, CoDi®, and Dimo®, and assign a unique CLABE account per purchase for your customers. Send funds to your merchants in real-time, 24/7, with no chargebacks.

Loan, Credit, and Factoring

Instantly verify the beneficiary of any CLABE account, confirming their name and tax ID (RFC/CURP) through the official CEP system. Automate real-time fund collection and dispersal, and optimize your factoring model to streamline the collection of accounts receivable, improving your company's liquidity.

Insurance and Bonds

Facility your insurance collections with SPEI®, CoDi®, and Dimo®: assign a unique CLABE to each policy to identify every payment and send bulk commissions in seconds.

Services

Streamline your collections and payouts using Mexico's leading digital payment methods: SPEI®, CoDi®, and Dimo®. Integrate with STP and manage every transaction seamlessly.

SOCAP

Enhance your services by offering your partners and members the flexibility of modern digital payments, including SPEI®, CoDi®, and Dimo®.

SOFOM

Power your financial services with our digital payment infrastructure, built on SPEI®, CoDi®, and Dimo®, to optimize collections and automate bulk payouts. Instantly identify the beneficiary of any CLABE account confirming their name and tax ID (RFC or CURP) via the official CEP system ensuring every payment is secure.

Software

Enhance your platform by integrating payments and collections through SPEI®, CoDi®, and Dimo®.

Remittance and Transfers

Instantly disperse remittances directly in local currency (MXN) through our powerful API integration. Verify beneficiaries in real-time and manage your payouts through a fully digital and secure process, with no additional currency conversions needed.

Want to Simplify Your Financial Operations?

Our technology adapts to your needs, helping you optimize and reduce your company's operational workload.

Automate your transactions

Reduce manual tasks, process payments and collections automatically, minimizing errors in your operation.

Learn more

Perform CEP Account Validation

Instantly validate any account by retrieving the holder's name and tax ID (RFC or CURP) through the official Electronic Payment Receipt (CEP) system, backed by the Bank of Mexico (Banxico). This allows your business to actively mitigate fraud and identity theft, ensuring every account belongs to the correct beneficiary before funds are ever transferred.

Learn more

Systems integration

Boost your business's operational efficiency through our API integration. Automate payments, collections, and balances, all from your own system.

Learn more

Our reliability, according to our clients

"We wouldn't have been digital without STP. A commercial bank cannot be compared"

Concrédito

Company

“With STP I can pay my clients more quickly and easily”

Caliente

Company

“STP simplifies our lives”

Ganabet

Company

“Our school's parents are pleased to use STP as a payment method”

Colegio Suizo

Company

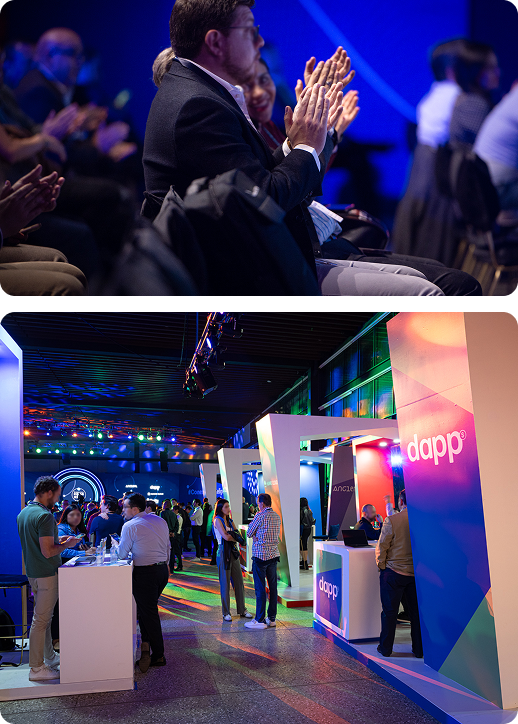

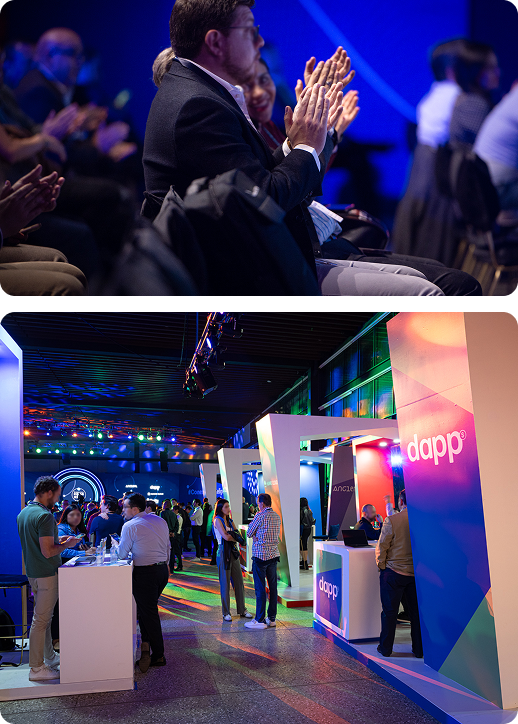

STP SUMMIT

The annual gathering where decision-makers from all sectors converge to explore digital payment methods and financial innovations.

We spark intelligent connections between leaders.

Each edition is an opportunity to discover trends, forge alliances, and engage in high-level networking.

We bring together top executives and leading companies from the industry to drive digital transformation and strengthen multiple sectors through payment solutions and financial technology.

FAQs

Alongside our digital collection and payment solutions, we also answer your frequently asked questions.

Can I integrate your services with my existing management system?

Yes! Our APIs allow you to directly integrate the payment and collection services you need into your system.

What is SPEI®?

SPEI® is the Electronic Interbank Payment System, a real-time payment system developed and operated by Banco de México, with strict security measures. It's the technology that enables electronic fund transfers.

What kind of security does STP offer?

Regulated by Banxico, CNBV, and Condusef, STP ensures that client financial transactions are processed through robust technology, preventing data loss and illegal use of funds.

How can I check my account balance and statements?

As a client, you'll have digital access to your account to check your real-time balance and transaction history. You can also download the statements you need.

How do I submit inquiries, clarifications, or claims regarding the platform service or my account transactions?

You can access all your transaction details in your account. We also provide a dedicated customer support team to address your questions, technical support, and a post-sales advisor to help you with complex issues.

How can I contact an advisor directly?

Call us at 55 52 6484 18 or visit our contact page to submit your information, and we will respond promptly.

Ready to take your business to the next level?

Let's find the best solution for your payment and collection needs.